The 5 Best Apps to Help You Track Your Spending Habits

We need to learn many difficult lessons as we grow up, but none so heartbreaking as learning that everything is a lot more expensive than we realized.

It becomes even more apparent when you get your first job and start tracking your income versus your outcome. Throw in the fact that college means you're often on your own and dealing with bills or student loans, and things can get overwhelming, fast. You begin to realize that you need to actually think about budgeting and spending habits. Thankfully, there are many ways you can easily track your spending, so you buy within your budget and stay on track. Here are five amazing apps that will help you track your spending habits.

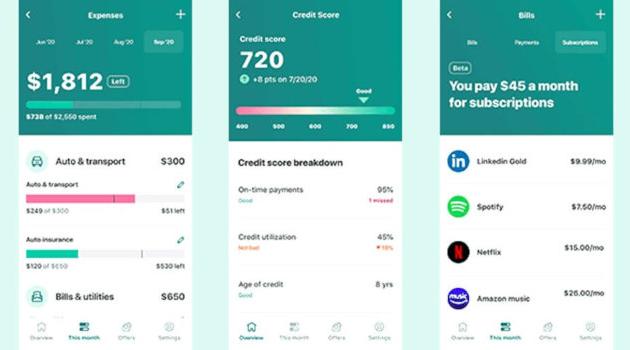

Mint

Mint is one of the most popular financial apps with a rating of 4.8 stars from over 600k reviews. It's an easy-to-use app that's helpful to everyone, from teenagers to business managers. You can track all your income and spending in one place and create a budget. Mint will not only notify you when your funds are low, but it will also make financial recommendations based on your goals. In addition, it has more advanced features like access to credit scores and investing, which you won't reasonably need when you're a teenager. However, these tools will be helpful to you one day, so it's excellent to familiarize yourself with the app now.

(via Shutterstock)

Wally

Wally links to over 1500 banks in 60 different currencies. It will automatically track your spending and sorts your transactions into different categories such as fitness, entertainment, social, and clothing sections. You can even create shopping lists within the app. A great feature that's unique to Wally is that you can scan and attach receipts with added notes. It's a great way to manage your receipts and easily see your purchases. In addition, you can set specific savings goals with target dates for days, weeks or months.

(via Wally)

Cleo

Cleo lets you create spending categories, set budgets and track transactions like other financial apps, but it is a more interactive experience due to AI technology. You can talk to the AI chatbot named Cleo and ask for advice on managing money. For example, you can ask, "Can I afford this?" and Cleo will respond with personalized advice based on your transactions. There is even a "Roast Mode" where Cleo will give you some tough love about your spending habits to keep you in check. This app is perfect for people who need more guidance with their financial decisions or looking for a more fun way to track money.

(via Shutterstock)

Splitwise

Do you find it challenging to keep track of who owes who in your friend group? Or maybe you have a trip planned and you need to split the cost of an Airbnb. It can be tough to figure out how to split a bill evenly when your friend group is out for dinner. This is when Splitwise will be the best thing to happen to you. Splitwise splits expenses for you and lets you and your friends track how much you owe each other. Just don't be that person that makes your friend pay you 78 cents because you drove them down the street.

(via Splitwise)

Nudget

Nudget was created to make tracking your spending as straightforward as possible. You can easily input your expense entries and categorize them yourself. It provides you with daily, weekly, monthly and yearly insights about your budget, total spending, where you are spending the most and least. You can see your spending habits with easy-to-understand graphics. You can add widgets to your iPhone home screen so you can always check in with your spending. It will even keep track of your recurring expenses so you can make sure you're not paying for any old subscriptions.

(via Nudget)

Looking for quality makeup without going over budget? Check out THESE fantastic cruelty-free makeup brands that you can get at the drugstore.